- Tight Inventory + Low Affordability = Strong Rental Property Demand

- Income Properties Outperform SFRs

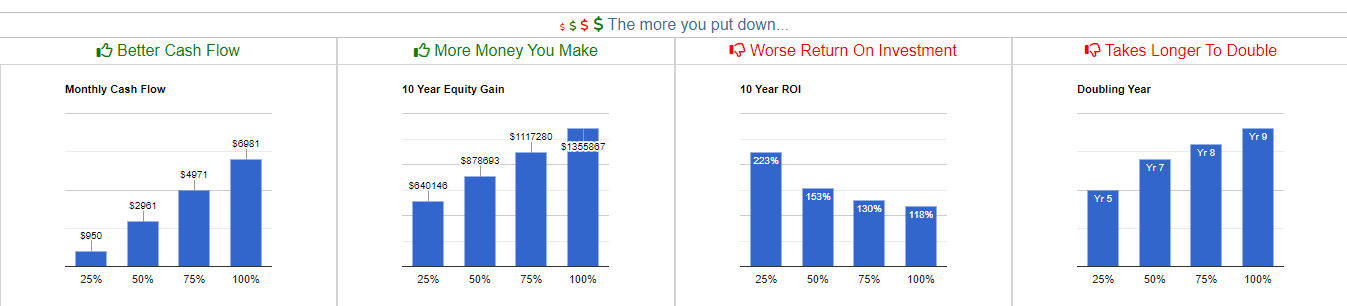

- Generates Cash Flow

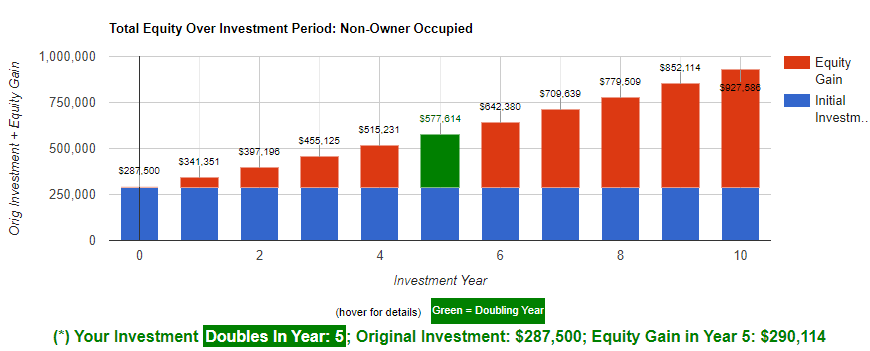

- Builds Equity

- High Returns

- Passive Income

- Hedge Against Inflation

- Stability

- Financial Independence

- Diversification

- Leverage

- Outperforms

- Tax Advantages

- Easy To Get Into

- Easy To Grow

- College Funding

- Early Retirement

- Legacy

- Cash Flow

- Appreciation

- Principal Reduction

* Tax Advantages can also positively affect your financial calculations, but are outside the scope of this discussion

- Residential:

- Single Family

- 2-4 Units

- Condos

- Townhomes

- Commercial:

- Multifamily (5+ units)

- Office

- Industrial

- Retail

- Fix & Flip

- Cash flow

- Appreciation

- Tax advantages

- Amount to make

- Amount to invest

- Total equity gain or ROI

- Investment period

- 1031 exchange

- Growth plan

- Exit plan

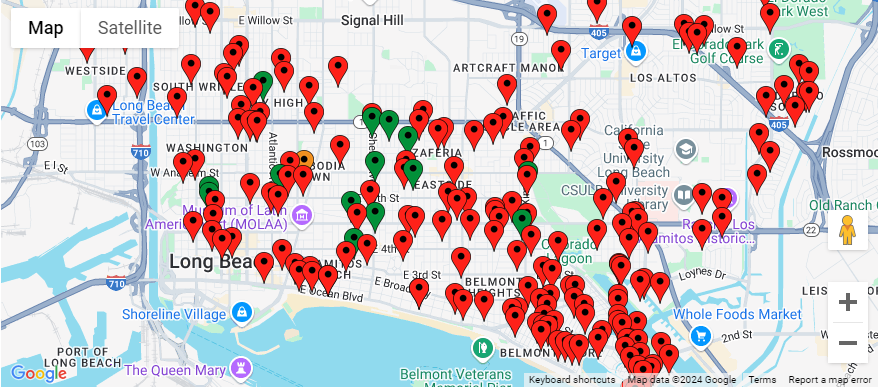

- Area

- Price range

- Down payment

- Total amount to invest

- Property type

- Number of units

- Owner occupied

- Gross Rent Multiplier (GRM)

- Capitalization rate

- Return On Investment (ROI)

- Configuration (beds/baths/sq ft, etc.)

- Condition

- See our SMART Investor Needs Assessment page

- Finding A Lender

- Qualifying

- Preapproval

- Restrictions

- Types of Loans

- FHA/VA

- Appraisal

- Creative Approachs

- Real Estate Agent

- Lender

- Tax Professional

- Insurance Agent

- Property Manager

- Attorney

- 1031 Exchange Rep

- Contractor

- Painter

- Electrician

- Plumber

- See our Build your team page