Long-Term Buy and Hold; 1-4 Units;

Los Angeles and Orange Counties

|

1. Tight Inventory + Low Affordability = High Rental Demand |

|

The supply of homes ("inventory") in the marketplace of all types is low compared to historical trends. In spite of that, property prices have risen extraordinarily over the last several years. This creates upward pressure on rental housing, both rents and income property prices.

As they always say for residential homes, "Now is a great time to buy..." residential income properties! |

|

2. Income Properties Outperform Single Family |

|

Income Properties Outperform Regular Residential

Income property prices have

more than tripled since 2009 (*)

Income properties have

faster annual growth rate than regular

(*) Since end of the Great Recession

|

|

3. Generates Cash Flow |

|

Most other investments (including your own home) require you to wait until you sell your asset before you actually make any money. The right real estate investment creates money in hand as you own it. Rents come in, expenses are paid, and choosing the right property in the right area will create positive cash flow for you to use as you see fit.

You also have the benefit of appreciation and principle reduction to add to your equity building, but most real estate investors find the monthly cash flow to be the most rewarding benefit. |

|

4. Builds Equity |

|

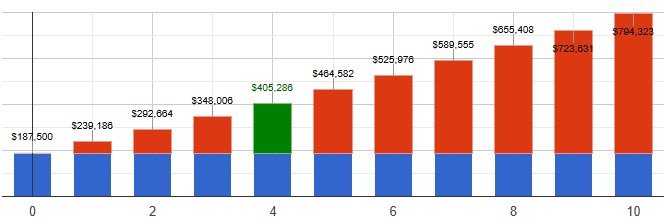

There are 3 ways to make money in real estate:

|

|

5. High Returns |

|

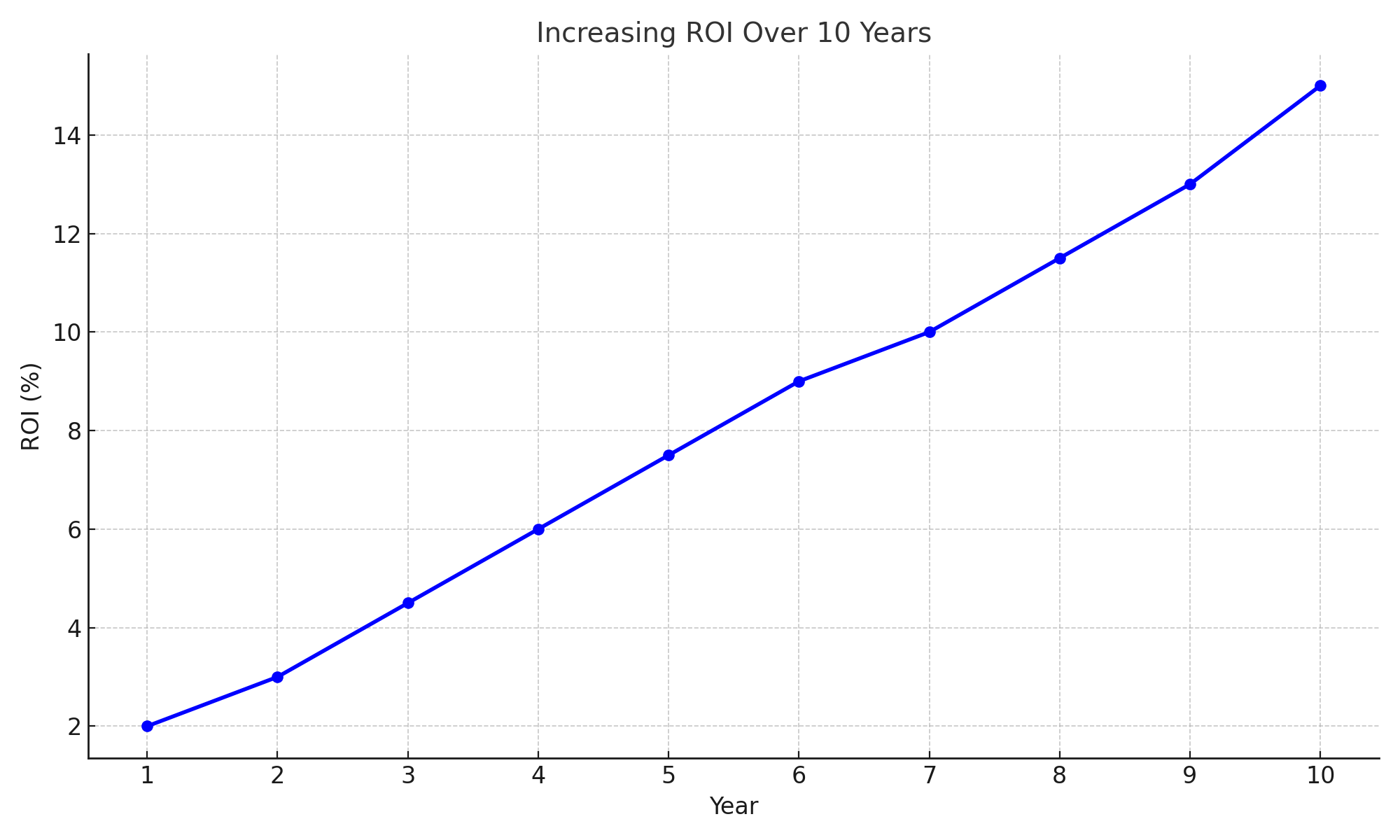

Due to the effect of leveraging, real estate investments typically have higher return on investment than other types.

By our calculations, you can more than double your money with many investments over time, typically in less than 10 years. You just need to know how to find them. |

|

6. Passive Income |

|

AKA mailbox money!

You have to know your stuff, but once you've found a great income-producing property and put it in the hands of a professional property manager, now you have passive income rolling in. Let someone else handle the midnight toilet emergencies. You will likely have infrequent involvement in the decision-making process, like "The fridge went out in Unit A: do you want to replace with a low, medium or high-end model?" Make it easy on yourself! |

|

7. Tangible Asset |

|

Unlike stocks, bonds, derivatives and crypto, real estate is a physical asset with intrinsic value. There is always long-term demand that has inherent utility.

And supplies are limited. |

|

8. Relative Stability |

|

One of the most attractive aspects of residential real estate investing, compared to other types of investments, is its stability. In the stock market, for example, you can instantly buy and sell all or portions of your holdings. This is great if you need to move fast, but it results in massive market shifts just as fast. As recent events have indicated, the stock market can easily go up or down 5% or 10% in a day, and individual stocks can gain or plummet much more.

The real estate market is intentionally designed to reduce volatility. Prices go up and down over time, but the process of purchasing or selling real estate is much more deliberate, and protects the larger investment. The system has worked for a long time. According to the U.S. Census Bureau, the average home value has increased about 6%/year since the middle of the 20th century. That's pretty stable, and impressive! |

|

9. Financial Independence |

|

There are many reasons to invest in real estate. Foremost is "independence".

You can do it as a side activity to augment your income, or you can become a full-time, professional investor. It can be as small as you want, with 1 or 2 units, or you can grow to apartment buildings, and build your real estate empire. It's up to you once you get comfortable with it, and what your needs and dreams are. Either way, it's your business! |

|

10. Portfolio Diversification |

|

Every professional financial counselor advises diversification of your investment portfolio. SMART real estate investing should be as strong a component of your holdings as stocks, bonds and mutual funds.

Great leverage and relative stability make it generally more attractive than other types of investment. |

|

11. The Power of Leverage |

|

Real estate investing is, in our opinion, the best way by far to leverage your investment dollars. With most other types of investments, such as stocks, you have to put up the entire amount, and your fortunes rise and fall directly with the value of the invested amount.

For example, if you buy some stock for $10,000 and it increases in value to $20,000, you have doubled your money, or reaped a 100% return on investment (less administrative costs). With residential real estate investing, in the 1-4 unit space, you typically put down 25%. So buying a $400,000 property, you would have to put down $100,000. If it doubled in value over, say, 10 years, the property value would have increased 100%. If you sell it then for $800,000, your gross gain is $400,000, which is a 400% return on your original investment of $100,000 (ignoring escrow and other costs for simplification). Which would you rather have: a 100% return, or a 400% return? |

|

12. Tax Advantages |

|

Several factors can help your financial situation relative to income properties. The major tax benefits include:

*** We highly recommend that you consult your tax professional for complete and accurate tax and accounting information applicable to your situation. |

|

13. Easy To Get Into |

|

|

14. Easy To Grow |

|

Real estate investing is traditionally the best way to leverage your assets, time and involvement. Many smart investors start out with an investment single family residence, condo or duplex, then, after experiencing success with that type, continue to build on their success buying similar types of units.

Start with a single family home to rent, or a duplex. These are easy to obtain and manage, and you can live in one unit in a duplex while you get to understand more about the investing process. Consider expanding to 3 or 4 units, or even 5+ (apartment buildings). These generally cost more but they better leverage your investment dollars on a per unit basis. This creates a "money machine" effect, where you build on your strengths and experience by repeating past successes. Other smart investors like to gain traction with smaller units, then work with larger properties, such as triplexes and fourplexes, utilizing the same techniques but leveraging their base investment even more with larger properties. |

|

15. Relatively Low Risk |

|

Essential demand

|

|

16. Inflation Hedge |

|

Property values often rise with inflation

|

|

17. College Funding |

|

The best thing to do is to start early. That’s usually hard for most people who are many years away from retirement and may not even have a family yet.

But the advantages are enormous. Real estate typically appreciates at a higher rate than most savings plans. That plus equity growth by positive cash flow accumulation and principle repayment over time can build a great nest egg for your children or grandchildren. |

|

18. Early Retirement |

|

It used to be what everybody looks forward to. Now, many people are working well past traditional retirement age. If you find something that you love, you are successful at, or just need to keep doing for any reason, then go for it!

However, there will come a time when you will want to cut back, and maybe not be active in a work situation. When that happens, wouldn’t it be wonderful to have equity built up that you could tap? Our equity gain models help you figure out where you will be in 5, 10, 15 or 20 years. Residential real estate investing can get you where you want to be, when you want to be there. |

|

19. Legacy |

|

What better way to leave something to your heirs, or even just to get family members started in real estate investing?

Share the investment, share the rewards, then let them build their own real estate empire. |